How Much Do Tax Preparers Make?

Contents:

In general, any criminal offense resulting in a felony conviction under federal tax laws or a felony conviction related to dishonesty or a breach of trust, that is less than ten years old. Tax Preparation and Planning , Blogs An Introduction to Client Accounting Services Offering client accounting services has become increasingly common in the past few years. Federal pricing will vary based upon individual taxpayer circumstances and is finalized at the time of filing. You will also be able to handle tax matters, including audits, appeals, and collections.

- Finding work with tax preparation firms is one of the most common career paths for Enrolled Agents.

- Our Enrolled Agent professional faculty provide end to end assistance in getting EA certification.

- If you’re looking to speed up your salary gains without making a big career change, the best thing you can do is earn a professional designation, like the EA awarded by the IRS.

- It is for this reason many CFPs and advisors earn their EA credential.

- Consequently, entry-level positions start on the low end of these ranges, while senior positions claim the highest salaries.

Yet, in the mile-high city, over half of the EA salary figures posted are above $112,000 annually. And while they say everything’s bigger in Texas, this statement doesn’t necessarily hold true for Dallas enrolled agent salaries. But jobs posted in the area pay between $65,000 to over $130,000 annually. Like the CPA designation, earning the enrolled agent status can improve salaries for these tax professionals.

Staff Accountant (Remote)

Individuals looking to become an enrolled agent of IRS, follow these steps for how to take a SEE special enrollment exam. A great benefit of being an EA is having the ability to work for the IRS or state departments of revenue. This is at the heart of an EAs core duties and responsibilities, and you’ll be guiding people through tax obstacles on a daily basis. Working in government means you’ll likely have better vacation, health, and retirement benefits, as well as increased job security. You may not be paid quite as well as if you worked in the private sector, but you may enjoy knowing you’re working for an entity meant to serve the public. Years of technical tax experience in public accounting, or related field CPA, Enrolled Agent , or equivalent certification is a must Ability to manage all aspects of client engagements..

However, an EA’s duties go far beyond these high level roles. The salary for an enrolled agent can vary depending on the years of experience that a person has, from entry level to senior level. Overall, it is easier and faster to become an EA than a CPA. Anyone is allowed to sit for the enrolled agent exam, which is not the case for the CPA exam. In order to sit for the EA exam, all that is required is a preparer tax identification number.

Recently Added Enrolled Agent Salaries

Therefore, the EA salary range in that city is significantly higher, starting at over $80,000. Enrolled agents in Charlotte also earn higher than the national average. Their salaries come in somewhere between $75,000 and $100,000.

It’s also necessary to pass a stringent background check if you want to become an EA. This is rather important as the IRS won’t allow you to become an enrolled agent if you have specific crimes on your record. With experience as a former Internal Revenue Service employee, you should work for at least 5 years in a position requiring experience in interpreting the tax code. Job Description Established and thriving firm in Maitland seeks to fill a position for an intern. We are a unique firm that values our clients and staff much like family. You know if you are being paid fairly as an Enrolled Agent if your pay is close to the average pay for the state you live in.

Test centers are located in most major metropolitan areas. Once you have your PTIN, you may register online at /irs for your Special Enrollment Exam. Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. There are limits on the total amount you can transfer and how often you can request transfers. Pathward does not charge a fee for this service; please see your bank for details on its fees. Line balance must be paid down to zero by February 15 each year.

Pay

Each year, thousands of nonresident aliens become gainfully employed in the United States. Thousands more own rental property or earn interest or dividends from U.S. investments. Serving an international client base, this type of career lends itself most often to a telecommuting career. As of 2021, the BLS estimates the total number of tax preparers working in the United States at 83,190 professionals.

- Just like you would working in the private sector for tax clients, you’ll be tasked to educate, assist and counsel but on behalf of the IRS.

- Becoming an enrolled agent can be a very rewarding career.

- According to the Treasury Department guidelines, you must have at least 5 years of active, continuous service in order to become an EA.

- Candidates who pass a part of the examination can carry over passing scores up to three years from the date the candidate passed the examination.

Qualified candidates must possess CPA or Enrolled Agent designation. First, it is important to understand the difference between an enrolled agent and a CPA. The bigger the city, the higher the median EA salary.

It’s also not necessary to have amortization definition in accounting or math. However, it can be rather helpful to complete tax training. Our Enrolled Agent professional faculty provide end to end assistance in getting EA certification.

Payroll in Practice: 3.6.2023 – Bloomberg Tax

Payroll in Practice: 3.6.2023.

Posted: Mon, 06 Mar 2023 08:00:00 GMT [source]

Exp working with high net worth clients and directly with business owners. Excellent verbal and written communication skills.Skills PreferredCPA or Enrolled Agent preferred. Strive Tax and Accounting is looking for a full time CPA that is an Enrolled Agent and holds a.. We are seeking a skilled and experienced Enrolled Agent to join our team. The City is accepting applications from candidates who are currently enrolled in a recognized police academy or who have graduated from an academy within the last 3 years.

How Do I Know If I’m Being Paid Fairly As An Enrolled Agent?

Use the study guide and free test bank to sharpen up in those areas and go take the exam! The free test bank momentum meter is different, but the higher the better. In either tool, you can review your answers, whether correct or incorrect, and review the rationale. Plus we always list the exact chapter in the EA book to reference so you can improve in that specific area. Between the book and the testing tools, you will have covered every topic needed to pass the exams the first time.

This https://1investing.in/ usually involves a busy season, with the highest workload occurring from December to mid-April. The average Enrolled Agent salary in the U.S. is $52,645 according to Payscale Opens in new window. This is over $4,000 more than a non-certified tax preparer’s average salary. We’ll break down how much Enrolled Agents make throughout each stage of their career and cover how you can increase your earnings. EAs are federally authorized to represent taxpayers before the IRS and have unlimited representation rights.

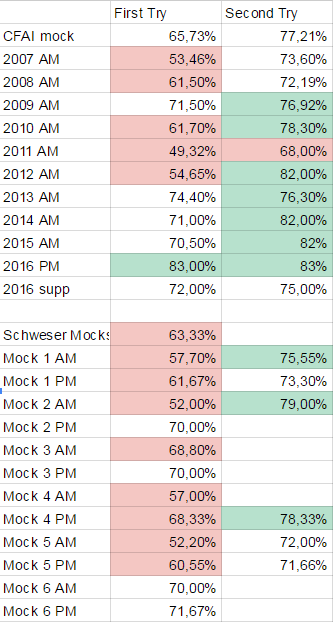

Momentum of 79% or less, use the reports to find out where you’re weak. Go back to the study guide and free online test bank and attack the weak areas. Then, take another practice exam to measure your improvement.

The ideal candidate will have previous Aged Care experience as an Enrolled Nurse in Australia, who is.. Years of experience CPA Certification or Enrolled Agent Interested in hearing more? The Tax Support Enrolled Agent position is responsible for..

Recent Comments