The Small Business Guide To Payroll Deductions

Content

Employers are required to perform new hire reporting with a designated state agency shortly after hiring employees. They must verify that employees are legally allowed to work in the country and give them the necessary tax forms to complete. This includes a W-4 for federal income tax withholding and, if applicable, the state’s tax-withholding form. Without the form, it’s difficult for employers to accurately withhold employees’ taxes. The new hire reporting process requires employers to submit basic employer and employee information to the state agency.

These percentages do change, so always be sure you are withholding and matching the correct amount for the tax year. The standard payroll deductions are federal income tax, state income tax, Social Security, and Medicaid. Because voluntary deductions are optional, you should make sure your employees are fully aware them. Obtain an employee’s written consent before withholding insurance premiums or any other benefit from their pay.

Allowable Paycheck Deductions

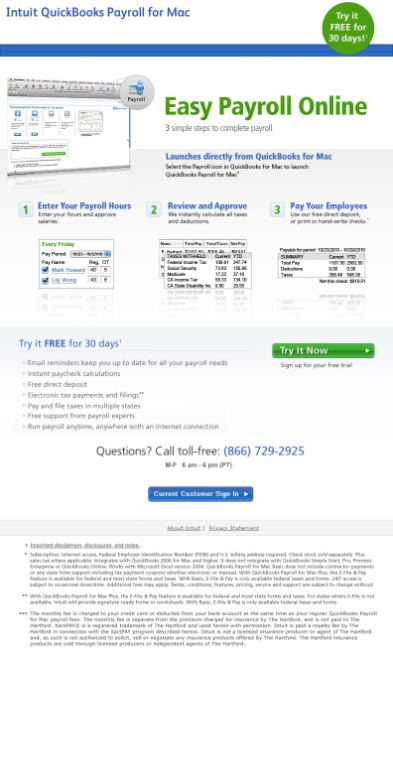

While it may not be the most fun — or easy part — of What You Need To Know About Payroll Deductions ownership, running payroll comes with the territory. When in doubt use our free payroll tax withholding calculator to handle the details so you can focus on other things. While the math you have to do to calculate deductions and withholdings isn’t very complex, it can be daunting to keep all the moving parts straight.

- Federal income taxes go toward public services such as transportation, education, and the military.

- This equals 7.65% in FICA taxes per paycheck , which you are legally obligated to match.

- For any of the deductions listed above, employers may charge retail prices and reasonable interest for loans, but they cannot otherwise financially profit or benefit.

- For eligible employees, deductions for FEHB are made from the employee’s pay at the biweekly rate applicable to the employee’s elected health plan in the Schedule of Subscription Charges.

- These are known as voluntary payroll deductions and they can be withheld on a pretax basis or post-tax basis.

You must report them on Form 941 or Form 944 and remit them electronically using EFTPS . Automatic giving allows employees to support their favorite cause by having a pre-selected amount deducted from their paycheck throughout the year. Remember to get a written or electronic opt-in for this type of deduction and work with a reputable partner like United Way. Neither of these plan features is mandatory, and some FSA plans will not include them. It’s a good idea to check with your benefits department to see if these special rules apply to your FSA account. Otherwise, if you put more money than you need in your FSA, you will lose it at the end of the year. Subtract garnishments, contributions to Roth IRA retirement plans and other post-tax dues to achieve the total net pay.

Payroll Deductions

A 401 is an excellent way for employed individuals to sock away large sums of money on a pre-tax basis each year. For example, the annual contribution limit in 2022 is $20,500, rising to $22,500 in 2023. Individuals who are over 50 are covered by the catch-up rule, which permits them to contribute an extra $6,500 each year. Explore our full range of payroll and HR services, products, integrations and apps for businesses of all sizes and industries. Even in the above-mentioned cases, your employer should let you know when they’re going to make a pay deduction so that you can prepare for it. There’s no fixed amount when it comes to deducting employee wages. However, you can’t deduct their monthly to a level that’s lower than the National Minimum Wage or the National Living Wage.

Social Security is a program that provides disability benefits, retirement funds, survivors’ benefits, and family benefits. Employers are responsible for deducting 6.2% of an employee’s annual salary which goes towards Social Security. The amount of federal income tax that is due will vary by employee.

By Business

Employer pays both employee and employer shares to the IRS. Workers’ compensation insurance for medical costs and wage replacement if injured on the job. Learning all you need to know, keeping up on changes, and taking the time necessary to meet your requirements is time you’re not spending building your business. The burden is on you to prove someone who works for you is not an employee or a worker entitled to unemployment or workers compensation coverage. Many independent contractorsIndependent contractors must meet specific requirements to be considered exempt from employment laws.

Does it make sense to offer restaurant employees daily pay? – Restaurant Business Online

Does it make sense to offer restaurant employees daily pay?.

Posted: Fri, 24 Feb 2023 23:00:01 GMT [source]

Union dues – If the organization is unionized, most employees will opt into a union via union dues. Its purpose is to protect employees’ rights and provide workplace conflict mediation. By knowing the purpose of each deduction, you will quickly see how they are a vital part of your business model and HR plan. State or local tax agency to ensure that you’re complying appropriately with their regulations.

What payroll reporting and tax responsibilities do employers have?

Your financial situation is unique and the products and https://intuit-payroll.org/s we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication. The exact amount of tax depends on the salary of the employer, but it is higher than the regular tax rate. If the Netherlands deems that your company has a permanent establishment and you’re not meeting your taxation obligations, this can be considered tax evasion or worse, tax fraud. Both crimes come along with huge fines and even possible jail time, apart from the obvious resulting public relations nightmare. If you’re employing a worker in another country, you may be concerned about permanent establishment risk – the risk that your company is established enough in that country to be taxed.

- Form SF-1187, Request for Payroll Deductions for Labor Organization Dues, is used for requesting and authorizing the withholding of membership dues and payment to the appropriate organization.

- Calculate accrued sick time based on regular and overtime hours worked.

- “Permanent establishment “ (also called “substance requirement”) is a tax term for businesses that have an ongoing presence in a country.

- If you don’t pay the correct overtime rate, you’ll have to pay more to cover fines, interest, and penalties.

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. Deduct 0.9% for Additional Medicare tax if year-to-date income has reached $200,000 or more. Take your organization to the next level with tools and resources that help you work smarter, regardless of your business’s size and goals.

Federal income taxes are regulated by the federal government and are used for national programs like defense, education and community development. To take mandatory and voluntary payroll deductions, the employer must first determine the employee’s salary, called gross pay, that was earned during the time period.

The first and most common deduction from wages is for a pension fund. In this scenario, you have employees who have enrolled in your workplace pension fund that you set up. The payments are usually automated to deduct wages from the employee. Failure to execute payroll tasks appropriately can result in penalties from the administering government agencies. In general, they include the application of federal, state and local labor and tax laws. By knowing some critical things about payroll, you reduce the likelihood of errors and penalties. Except for the deductions listed above, any deductions from final paychecks may not take the employee’s final paycheck below the minimum wage.

Recent Comments