Wholly owned subsidiary definition

That risk may increase when local laws differ significantly from the laws in the parent company’s country. Acquiring a wholly-owned subsidiary may force the parent company to pay a high price for the subsidiary’s assets, especially if other companies are bidding on the same business. The parent company is likely to apply its own data access and security directives for the subsidiary to lessen the risk of losing intellectual property to other companies. Using compatible financial systems, sharing administrative services, and creating similar marketing programs help reduce costs for both companies. A wholly-owned subsidiary is a company whose common stock is 100% owned by a parent company. Wholly owned subsidiaries also offer an opportunity for firms to diversify and manage risk.

It also talks about the accounting and tax advantages of wholly-owned subsidiaries. The parent company controls the management of the subsidiary at some level. The integration of both their teams can lead to better administration and development. A wholly-owned subsidiary is a company that has a parent company that owns its 100% common stock.

- As such, there are no minority shareholders, and its stock is not traded publicly.

- However, establishing a wholly owned subsidiary could outcome within the father or mother firm paying an excessive amount of for assets, especially if other firms are bidding on the identical business.

- To recognize or offload taxable income, depending on the tax rates where the subsidiary is located.

- The amount of control by the parent company on a subsidiary company depends upon the level of managing control the parent company gives to the subsidiary company management staff.

To the group to merge with the parent financials on each reporting date as per the accounting framework. There are certain exemptions for the wholly-owned subsidiary company in legal and tax laws to encourage new investment by the parent company and create more companies to increase employment. As a majority stockholder, the mother wholly owned subsidiary meaning or father company has the ability to remove or appoint board members for the subsidiary firm and can be allowed to resolve how the subsidiary will function. When one enterprise owns sufficient inventory in another firm to manage that company’s operations, a father or mother firm subsidiary relationship has been created.

What is the difference between a Subsidiary and a Wholly Owned Subsidiary?

A parent company can set up a subsidiary in any country, and it will be treated as an independent company for taxation purposes. A wholly-owned subsidiary is located in a country different from the parent company. The subsidiary will almost certainly have its own management team, products, and customers.

INVESTMENT BANKING RESOURCESLearn the foundation of Investment banking, financial modeling, valuations and more. Cash Flow StatementsA Statement of Cash Flow is an accounting document that tracks the incoming and outgoing cash and cash equivalents from a business. Establishing relationships among vendors, regulators, bankers, investors, lenders take a lot of time since they are unaware of the functioning of the subsidiary. A new or existing company requires a lot of time working on the diligence process and finally closing the transaction. Building relations with customers and investors becomes easy if the parent has strong connections in the market. Starbucks company Japan is a wholly-owned subsidiary of the Starbucks group.

In this case, there is a requirement to record all intercompany loans from the subsidiary to the parent. The management control over operations and processes remains with the wholly-owned subsidiary. In the instant case there is change in the beneficial interest of the shares held by Mr. A, therefore, declaration as prescribed u/s 89 shall be given by Mr. X and M/s BBC Ltd, a and thereafter by ABC Ltd. In case a transfer has not been registered in the books of a company, then the transferor shall be entitled to receive dividend if he is a registered holder as on the record date.

They must apply for licenses and permits and open a separate business bank account. A wholly-owned subsidiary is a corporation whose common stock is owned entirely by its parent company. It enables the parent firm to diversify, manage, and potentially decrease risk.

What is a Subsidiary Company?

An affiliate is a firm whose parent company owns percent of its stocks as a minority shareholder. Both the parent company and its wholly owned subsidiary might function as separate entities, unbiased of each other. In certain circumstances, the father or mother firm may be the only shareholder of the subsidiary. On the opposite hand, in various different subsidiaries, it’s their mother or father who owns greater than 50 percent of the controlling stock.

The profits from any of the parents or subsidiaries can cover their losses. Subsidiaries can be both wholly-owned and not wholly-owned, With a regular subsidiary, the parent company’s ownership stake is more than 50%. A wholly-owned subsidiary, on the other hand, is fully owned by the parent. This means that the parent holds 100% of this subsidiary’s common stock. A parent company can set up a wholly-owned subsidiary in a foreign market in a couple of different ways.

As noted above, a subsidiary is a separate legal entity for tax, regulation, and liability purposes. Parent companies can benefit from owning subsidiaries because it can enable them to acquire and control companies that manufacture components needed for the production of their goods. This is especially true if the parent wants to get into another market, such as a different country.

The wholly owned subsidiary model offers advantages from financial, operational, and strategic perspectives. Completing all adjusting entries and reviewing all financial statements is a must. If there have been any substantial profits, filing tax liabilities is necessary. After thoroughly reviewing all these essentials, the parent company can issue the financial statements. If the subsidiary is foreign-based, the parent can use its resources to initiate overseas projects. Later in 2006, Starbucks bought Sazaby League’s shares and became the sole owner of Starbucks Coffee Japan.

How Can a Wholly-Owned Subsidiary Be Established in a Foreign Market?

In some countries, licensing regulations make the formation of new companies difficult or impossible. If a parent company acquires a subsidiary that already has the necessary operational permits, it can begin conducting business sooner and with less administrative difficulty. These types of companies can be incorporated as a private limited company in India. They are treated as Indian companies under theIncome Tax Act, and they are also eligible for the deduction and exemption benefits like other Indian Companies. A company who choose to operate in more than one country can operate its business through a wholly owned subsidiary. Another type of beneficial entity is a wholly owned subsidiary for those who want to set up a permanent establishment in India.

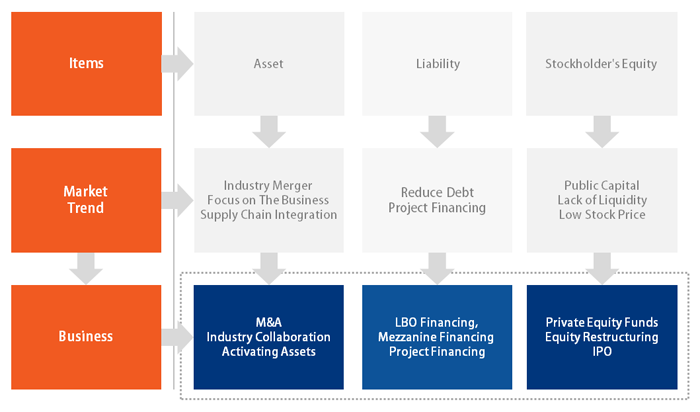

It provides a benefit of cost synergies in such a way by using a common financial system, sharing the administrative cost and other expenses between parent & subsidiaries. Two or more persons can hold one or more shares jointly and shall be treated as a single member. No objection letterfrom the parent company for use of the name of the parent company or the part thereof in the same of the proposed company. Set up Liaison Office/ Representative Office or a Project Office or a Branch Office of the foreign company which can be undertake activities permitted under the Foreign Exchange Management Regulations, 2000. The term mergers and acquisitions (M&A) refers to the consolidation of companies or their major assets through financial transactions between companies. Acquiring a wholly-owned subsidiary can be a relatively cost-efficient way for a company to expand its product line or its geographic reach.

An essential element in building a corporate structure is an organizational chart. Appoint workers for different roles and responsibilities basing it on the chart. Some jurisdictions require you to register the name under which you operate with local government agencies. Creating a business usually does not need registering with the country or city government.

How is Accounting Done?

In case of WOS of foreign company, foreign company wants to use same prefix as per their foreign company of incorporation of Indian company, NOC form the foreign company on their letter head required to use prefix. When foreign company makes 100% FDI in India through an automatic route, the Indian company becomes the Wholly Owned Subsidiary of that Foreign Company. Berkshire Hathaway is a holding company whose business is acquiring shares of other companies. Sometimes, a subsidiary can do things that the parent company cannot do on its own.

Financial statements from all subsidiaries are typically consolidated by the parent company. As a result, the subsidiary is not responsible for producing separate financial statements. Foreign businesses seeking to collaborate or form joint ventures with Indian-based businesses typically create a subsidiary or joint venture company. Since some foreign corporations prefer to maintain total control over their operations, they can establish a fully owned subsidiary in India. The wholly owned subsidiary and parent company can integrate their information technology and financial systems, resulting in reduced costs and expenses.

Although a holding firm owns the property of other firms, it usually maintains only oversight capacities and therefore doesn’t actively participate in running a enterprise’s day-to-day operations of those subsidiaries. A wholly owned subsidiary can be included in a consolidated tax return along with its different affiliated group of companies and, thus be filed by the parent company. In a subsidiary, the parent company owns percent of the subsidiary’s stock, making them the majority shareholders.

Since it is a 100% holding, all the funds infused in the subsidiary are of the parent company, and they are free to decide about the prospects as well. A conglomerate is a company that owns a controlling stake in smaller companies—independent operators in similar, but sometimes unrelated, industries. If the subsidiary has valuable proprietary technology, the parent company may attempt to turn the company into a wholly-owned subsidiary in order to have exclusive control over the subsidiary’s technology. This could give the parent company a competitive advantage over its rivals. Anderson is CPA, doctor of accounting, and an accounting and finance professor who has been working in the accounting and finance industries for more than 20 years.

Recent Comments